By Pat Hughes

For so many, the Great American Dream is to own a business; to build something from the ground up and see it succeed. I was bit by the entrepreneurial bug in 2003, when a partner and I started a small home building company. The time seemed right. The economy was solid and the real estate market was strong. Looking back, it’s remarkable how little I knew and how much I’ve learned.

You see, the decision to build a house sets off a chain reaction. First you find capital. Then you buy land. Then during construction you hire all sorts of people: architects and engineers, sub-contractors and tradesmen. At the end, is a brand new home that will see generations of growth.

At each link in this chain, everyone was happy. The land sellers were happy because they made money that fueled the next phase of their lives. The bank was happy, because we were paying interest on our loan. All the sub-contractors we hired were happy because they had work, which allowed them to provide for their families and continue to build their businesses. We were happy, because we made money and helped make a community a little nicer. The new owners were happy.

Perhaps the happiest group in this chain, however, was the local government. That’s because we increased the value of the property we originally acquired by 400%, increasing the tax base by a commensurate amount. Risk, hard work and private capital helping fill government coffers to better local schools and parks.

In the beginning, business was robust. So, I paid less attention to government policy. Unfortunately, business wasn’t very good for very long. By 2008, economic prosperity was vanishing. It became clear, as the economy declined, that this was directly related to the policies that were in place. It also became clear that it was time to pay closer attention to politics. Another, more painful kind of chain reaction.

Gradually, it became harder to find investors and obtain reasonably priced loan debt. Fewer people were looking to buy a new home in an unhealthy economy. As a result, my company created less and less work for our sub-contractors. The local tax-base slowed in its growth.

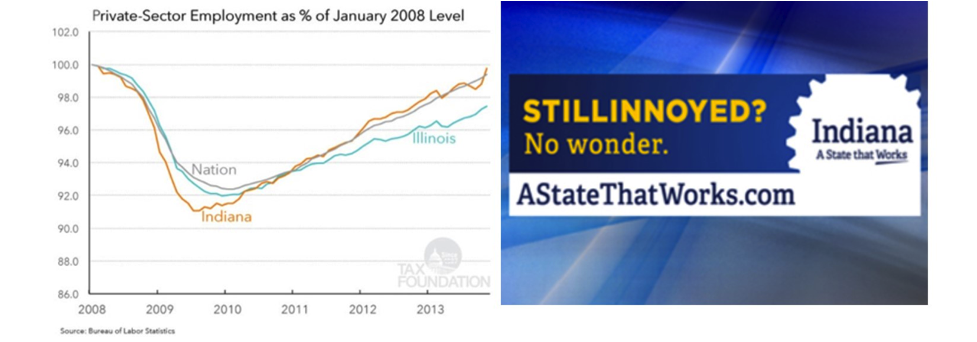

Then, in 2011 as families and business were struggling to climb out of the economic downturn, the ruling class in Springfield doubled down on their policies and passed the largest income tax increase in Illinois history. While Indiana, Wisconsin and other states held their tax bases and reigned in spending, Illinois continued to spend with reckless abandon. High unemployment, out-migration and credit rating declines predictably followed.

There is a lesson here for business owners and their employees. We must pay close attention to the policies coming out of Springfield. And we must engage in politics to change those policies.

This is where we should start:

- Illinois needs tax reform that rewards work and entrepreneurship, and spending reform that cuts unnecessary programs and roots out waste. To return to prosperity, Illinois needs to cut the state income tax and state corporate tax in half, as well as eliminate the state estate tax, which is a tax on businesses. We must implement statutory spending caps, return spending to 2011 levels, and then only allow for year over year growth equal to inflation plus population growth.

- Next, the state’s debt can be reduced if we allow the 2011 tax increase to sunset as promised. Ultimately, the tax relief would spur economic growth. That growth, combined with the reduction in spending, is the best course of action to return the state to solvency and improve our credit rating.

- Additionally, reforming our education system will be central to rebuilding Illinois. Too many students are currently trapped in underperforming schools. Continuing to reject school choice, which empowers parents to make decisions about their own children, in order to protect unions and the political establishment’s status quo is immoral.

- Finally, we need true pension reform that protects the retirements of state workers by moving them from an unsustainable defined benefit program to a modern 401K-style defined contribution system.

As entrepreneurs, we are at our best when we challenge ourselves. Being committed to achieving a big, seemingly impossible goal reconnects us to the passion that first kick-started our businesses. The process of working through a challenging project helps us uncover ingenious ways to solve problems.

We must not be discouraged by the political and economic environment in front of us. We have the ability to change our circumstances, as well as the circumstances of those around us, through our ingenuity, and a willingness to roll up our sleeves and get to work.

Understanding the policies that are needed to return opportunity and prosperity, and advocating for them as loudly as possible, has the potential to set off another chain reaction that leads to grassroots political involvement, new leadership, new policies, and ultimately, a stronger state and nation in which to build our dreams.

Patrick Hughes serves as a featured speaker for the Illinois Opportunity Project, a public policy enterprise that promotes legislative solutions in advance of free markets and free minds. He also serves as President of the Liberty Justice Center, a free-market public interest law firm that advances liberty through legal action.

In 2010, Hughes ran for the United States Senate. Pat is an attorney, real estate developer and homebuilder; as well as a husband and father of three.