By Pat Hughes

In an interview with CNBC, President Obama said: “if you’re basically still an American company but you’re simply changing your mailing address in order to avoid paying taxes, then you’re really not doing right by the country.”

The real question, however, is not why companies are fleeing the USA (and, likewise, states such as Illinois), but why the political establishment continues to drive them out?

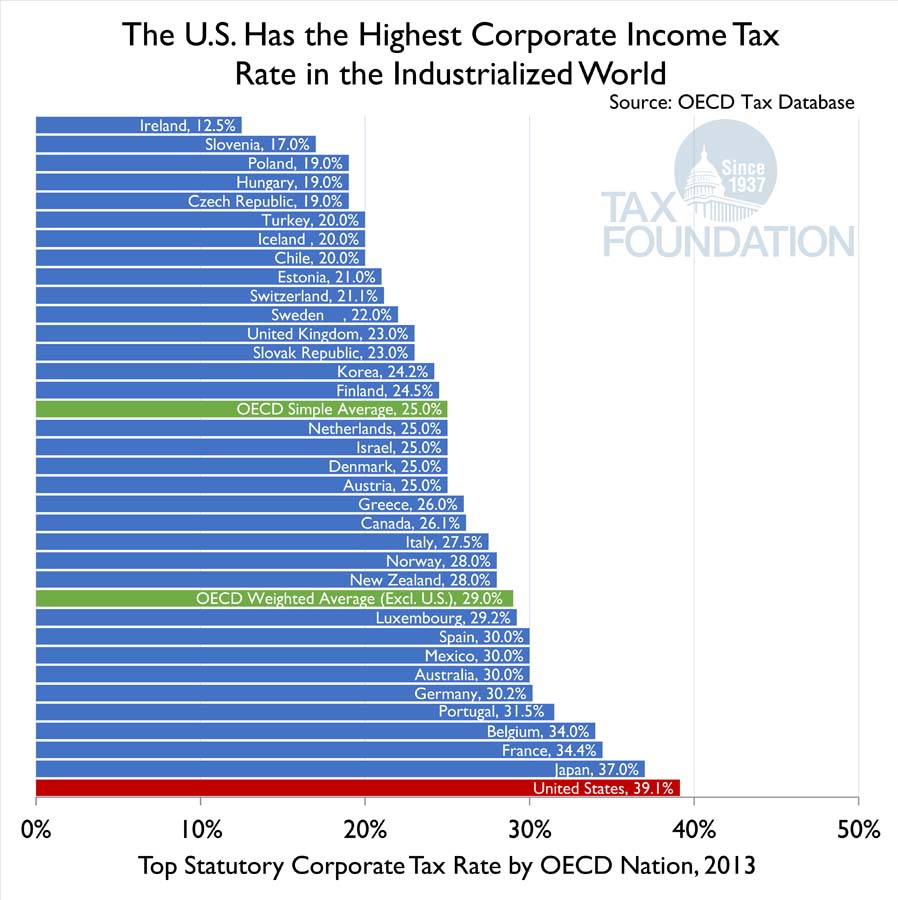

If we are committed to “creating jobs,” does it make sense to levy the highest corporate tax rate in the Western world on our biggest and best job creators?

We are doing it wrong. We should reward what we want to see more of, not punish it. If we want our economy to grow and new jobs to be created, then we need to incentivize localized capital investment and entrepreneurial activity in the private sector. We can start by reducing the tax burden on those that create jobs. U.S. corporations are increasingly at a competitive disadvantage. They currently face the highest statutory corporate income tax rate in the world at 39.1 percent.

Operating under a higher tax rate automatically puts U.S. based firms at a competitive disadvantage to their foreign counterparts. Developments in technology and greater global integration have opened international boundaries. Companies today face fewer road blocks to deter them from relocating their operations to areas that provide the most economically conducive environment. So they leave.

This phenomenon is even more prevalent at the state level where there are fewer costs associated with moving a business from one state to another as opposed to moving it internationally. A comparison of state governments provides a clear illustration of the relationship between corporate tax rates and a society’s ability to attract economic growth and opportunity.

In Illinois, we are burdened by the fourth highest flat-rate corporate tax in the country. As a result, businesses are relocating to other states at an accelerating pace. Forbes reported, “Illinois, with 61% more people moving out than in, has a depressing story to tell… over time the state has lost a third of its manufacturing jobs and a quarter of its jobs in construction, and a significant proportion of its unemployed have been out of work for the long term, so the real employment rate there is much higher than the relatively high official figure suggests.”

By contrast, Texas, with no corporate income tax, no property taxes at the state level, and no individual income tax, has one of the lowest tax burdens in the country. “Texas Friendly” is the mantra and that translates into one of the best business climates in the United States. Likewise, Florida provides a great example of tax policy that works. The state’s 5.5% flat rate corporate tax puts it among the lowest in the country. Moreover, because Florida has no income, estate or inheritance tax, it’s an attractive alternative for business owners struggling under the yoke of Illinois taxation.

The politicians currently in power—from President Obama to Governor Quinn—believe the corporate tax punishes the rich and powerful and is, therefore, an indispensable weapon in convincing voters that they are reducing inequality and redistributing wealth—that they are being “fair”. This a myth, of course, and those that advance it fail to realize the human cost of their policies. It is a cost borne by our longtime neighbor who was downsized and forced out of his home because a job never came. It is a cost borne by a son or daughter who must leave their family to find work somewhere else. It is a cost borne by the small business owner who closes the door on his life’s work because he can’t make the numbers work.

When a government that has overspent for years turns to tax increases instead of spending cuts and other structural reforms simply for the sake of “fairness,” it weakens free enterprise, lowers opportunity and impoverishes its people in a variety of ways.

We can do better. And we must do better for the sake of middle class taxpayers and job seekers who bear the brunt of the demonstrably failed status quo. The status quo preferred by those who sell a snake oil called “fairness” to consolidate political power.