By Pat Hughes

Rahm Emanuel has portrayed himself as Chicago’s “reform mayor.” As a candidate in 2011, he promised to “turn the page and bring in a new era of transparency, accountability and an end to business as usual in city government.”

So how does his record stack up to his rhetoric?

- Pension shortfalls have loomed over Chicago for several years, but tax increases and cuts in city services have not adequately addressed the funding issues.

- Chicago Public Schools (CPS) have a bond rating of “Junk.” And, each year, we send about 400,000 children into a system that will fail to bring the majority of them to grade level achievement by the end of the school year.

- The city leads the nation in violent crime.

- And, according to Internal Revenue Service data, Cook County lost a net of 379,000 taxpayers to its six neighboring counties from 1992 through 2012. When dependents are included, Cook County lost nearly a million people. Those taxpayers took more than $19 billion in taxable income with them.

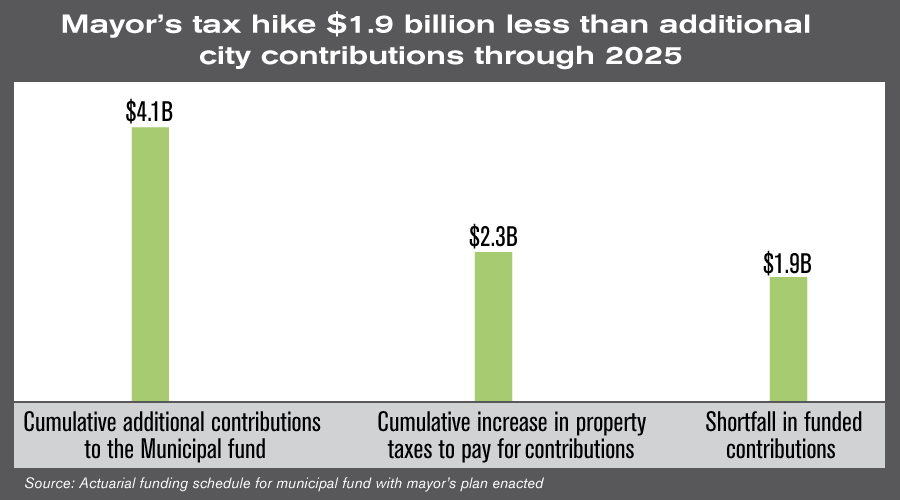

Today, the “Reform Mayor” unveiled his 2016 city budget, ostensibly paid for by the largest collection of tax and fee hikes in Chicago’s history. Emanuel is pitching the idea that over $500 million in new property taxes and several other tax and fee hikes are necessary to secure Chicago’s financial future. The tax hikes are intended to generate the funds necessary to shore up police and fire pensions and school construction. Emanuel’s plan also imposes a garbage-collection fee on property owners that will generate $100 million more. The $500 million property tax increase will cost the owner of a home valued at $250,000 about $500 more each year. The garbage fee will be an additional monthly assessment of $11 to $12 per household.

The mayor’s 2016 budget will also include:

- A tax on e-cigarettes and other smokeless tobacco products, which is roughly equivalent to the $7.17 tax slapped on a pack of cigarettes purchased in Chicago

- The “Netflix Tax,” which is a 9 percent tax on what official documents call “electronically delivered amusements” and “nonpossessory computer leases”

- A $1 per ride surcharge on Uber and other ride-hailing services

- A penny-an-ounce “fat tax” on sugary soft drinks

The worst part of all of this is that, as monumental as Emanuel’s proposed tax and fee increase is, it won’t solve Chicago’s fiscal problems, mainly because the Chicago Public School’s $9.5 billion pension crisis remains unaddressed in the Mayor’s proposal. The short term increase in revenue will only temporarily fill gaps in city budgets and further delay the necessity to implement structural reforms that could improve the city’s fiscal outlook in the long-term.

Moreover, without real pension and spending reforms, more property tax hikes will be forthcoming. More residents will flee the city, as a result. The city’s economic crisis will be accelerated. And one of the world’s great cities will continue to wither under Emanuel’s “leadership”.

As it happens, Mayor Emanuel has famously offered advice on how to act in a crisis. His words of wisdom? “Never let a crisis go to waste. What I mean by that is it’s an opportunity to do things you didn’t think you could do before.” Chicago is indeed in crisis. And Chicagoans now have a real opportunity to challenge the political status quo and demand the reforms they were promised – at school board meetings, at city council meetings and at the ballot box. Let’s not allow this opportunity to go to waste.